Track mileage automatically

Get started

Should you use an app to track your mileage?

If you drive for work, kilometre tracking is an indispensable part of your day. Tracking every work trip ensures that you maximize your vehicle expenses claim. You need to keep records of your driven kilometers as proof of your claim. You can take advantage of the mileage deduction whenever you drive for business purposes. Whether you work for a ride-sharing firm like Uber, work as a consultant who often meets clients outside of work, or provide in-home services, keeping track of your mileage allows you to receive the reimbursement you are entitled to.

Records should contain the following:

- The start date of your logbook and the vehicle’s odometer reading on that day

- The date, distance, and reason for all business trips

- The end date of your logbook and the vehicle’s odometer reading on that day

How do I keep a vehicle log book of driven kilometres?

There are a few ways you can track your kilometres, including a paper logbook, a spreadsheet, and a mobile tracking app. Each of the ways come with their pros and cons. A logbook app is probably the best choice as it allows you to automatically track your trips. However, we suggest you check out all options and pick the one that best suits your needs.

Using a paper log book or spreadsheet

You can use a paper log or a spreadsheet to track the KM you’ve driven. You should always include the required details for each trip as described above - not just the distance, but the date and reason for the business trip. If you drive often, it can take a while to write down every trip detail, and of course, we’ve all forgotten to record trips in the past! In this case, a mileage tracking app could be just the solution for you.

Log book apps

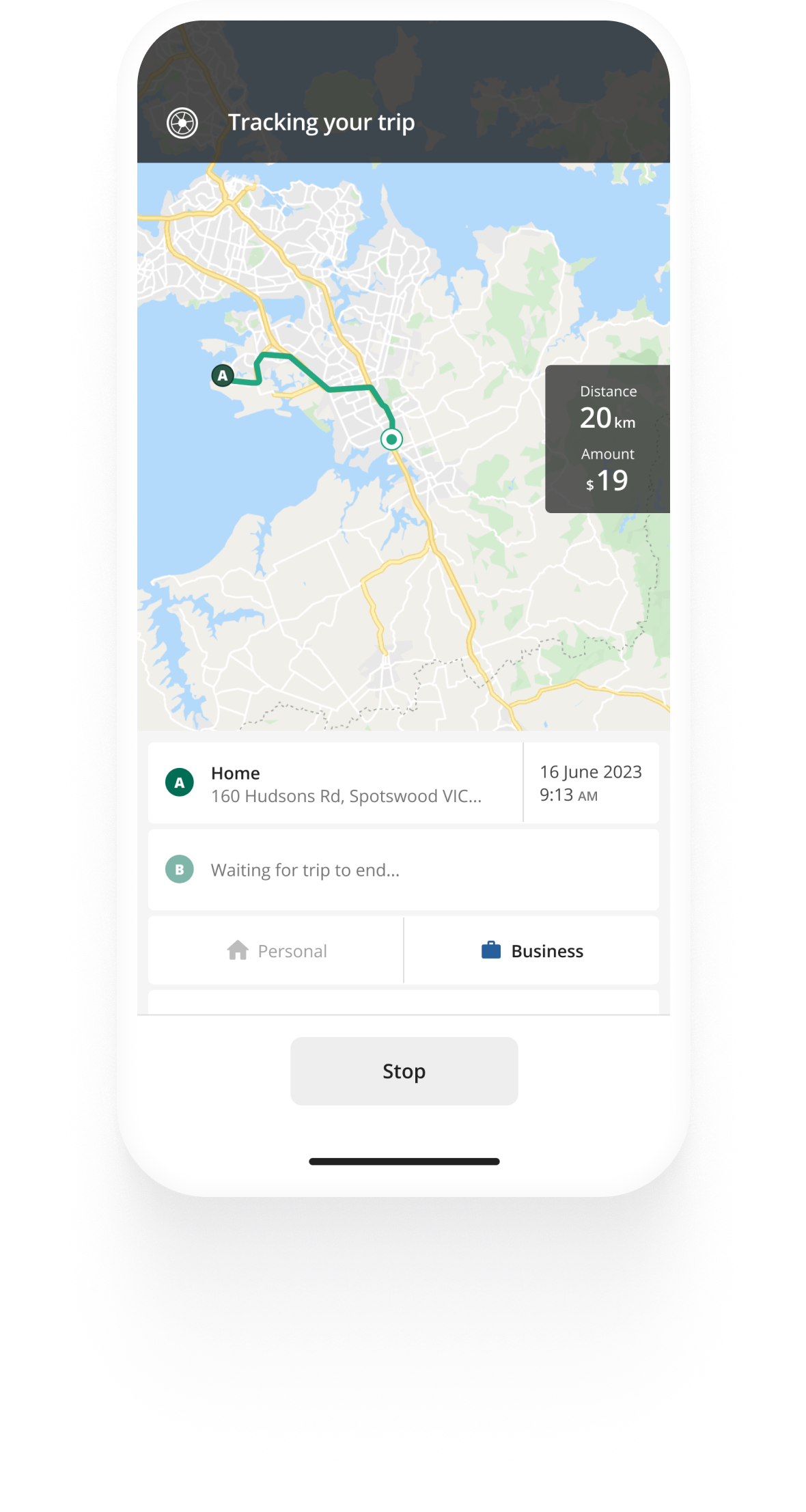

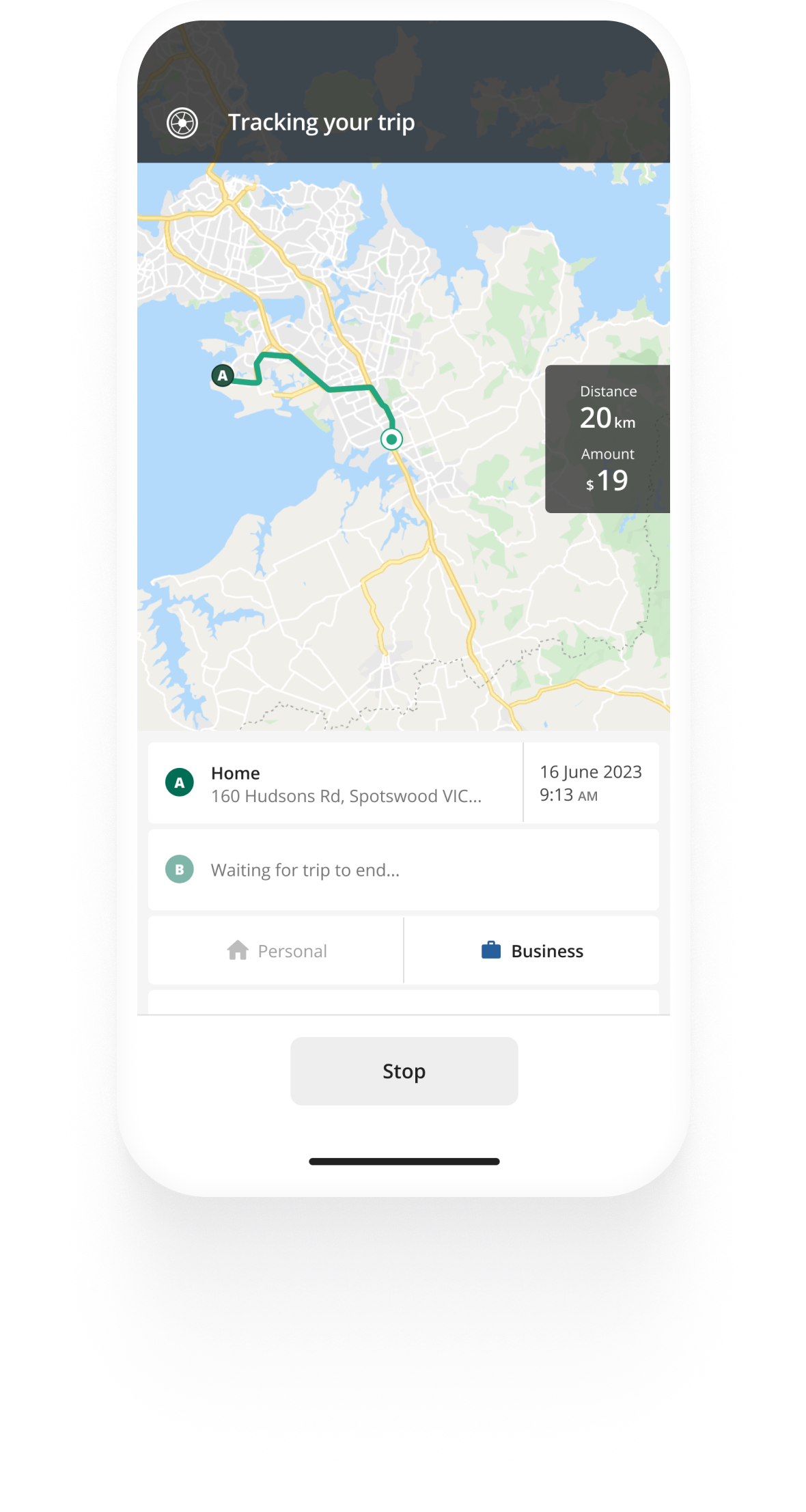

Apps for keeping a log book can track your driving in real-time and save you the hassle of writing down information about every drive you take. You simply open the app and start tracking - the app will then record your trip while you are driving. Once you finish your trip, just stop the app from tracking - you’ll have a logged trip including the start and end time, start and end point, distance and you’ll be able to specify the purpose of your trip.

Some apps for keeping track of driving offer automatic tracking too - no need to even open the app. With Driversnote, you can track automatically every trip, or use an iBeacon - a low energy Bluetooth device that you place in your car. The iBeacon will prompt your phone to start tracking a trip every time you get in the vehicle you use for business trips and start driving. When you exit your vehicle, the app will stop recording your trip. You’ll have all of the required information, as well as a very accurate log of your trips.

Now that you know what you need to log for your car expense claim, let’s see how you calculate your vehicle expenses claim.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

How to calculate your claim using the IRD kilometre rates

Calculating your vehicle expenses claim is an easy task if you’ve kept a logbook of your business and personal driving regularly. You’ll need the total kilometres you’ve driven for business and the standard IRD kilometre rate. Grab a calculator and simply multiply the miles by the IRD kilometre rate - the result is the amount of deduction you can claim.

How to calculate your car expenses claim with a mileage tracking app

If you are using a mobile app to track mileage, the app will do the calculation for you - you’ll also be able to create compliant logbooks to keep as proof of your vehicle expenses claim.

Few things will make your accountant happier than receiving adequate, consistent documentation for your tax return year after year - and an app will help you do exactly that!

Apps for tracking mileage will keep your vehicle log safe

Using an app will remove the task of organising and keeping a logbook from your hands - tracking apps will keep the information for you and your full logbook will be just a few taps away at any time.

If you’re using paper or spreadsheet logs, make sure to properly save and file them - the IRD states that records should be kept for 7 years in case of audits.

If you use Driversnote to record your driving, you can rest assured that we retain your tracked trips for as long as you keep an account with us - regardless of whether you have a paid subscription or a free account, your data is safe with us.

Latest posts

- IRD 2022-2023 Kilometre Rates

- IRD kilometre rates 2023-2024

- Denmark Increases Mileage Rate Due To Rising Fuel Prices