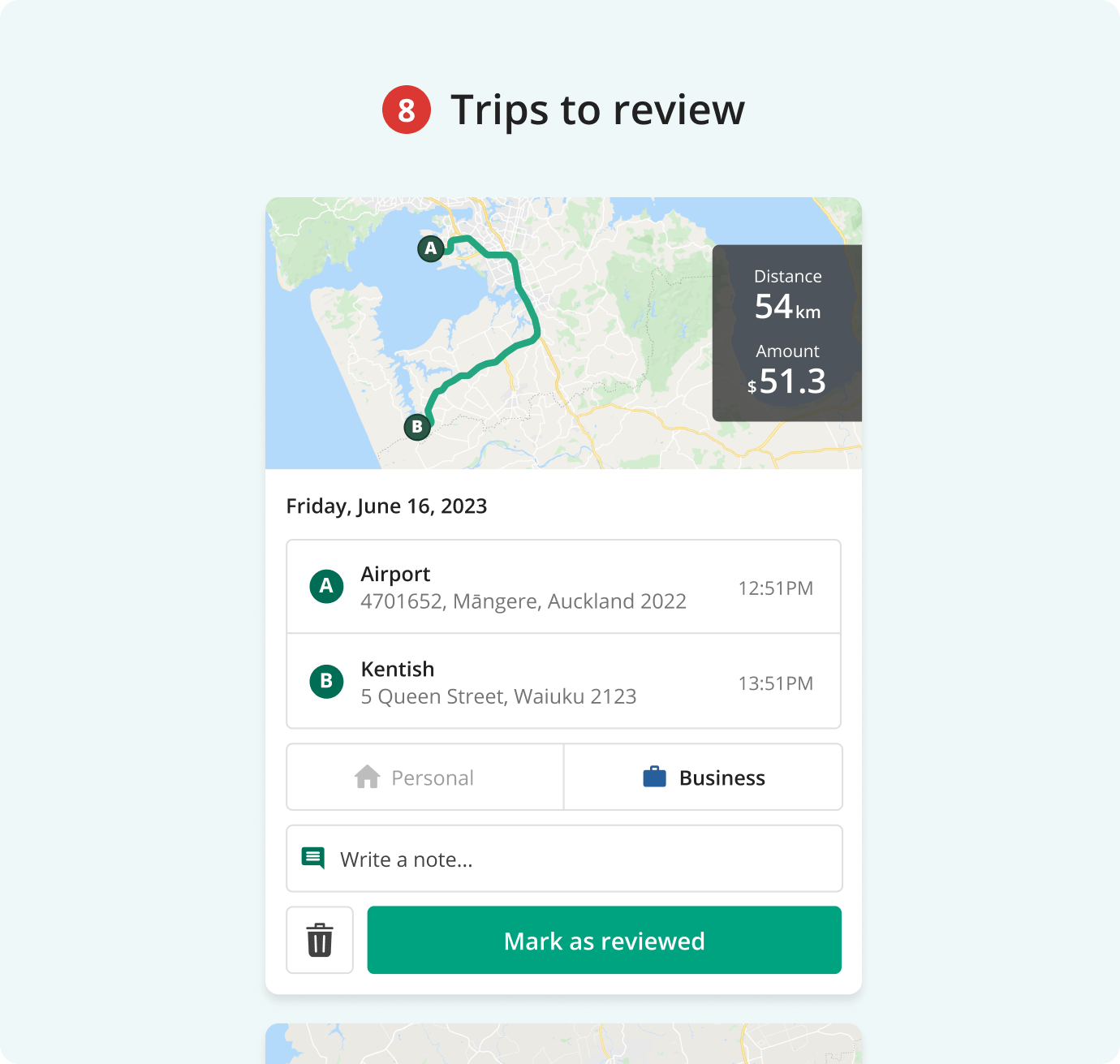

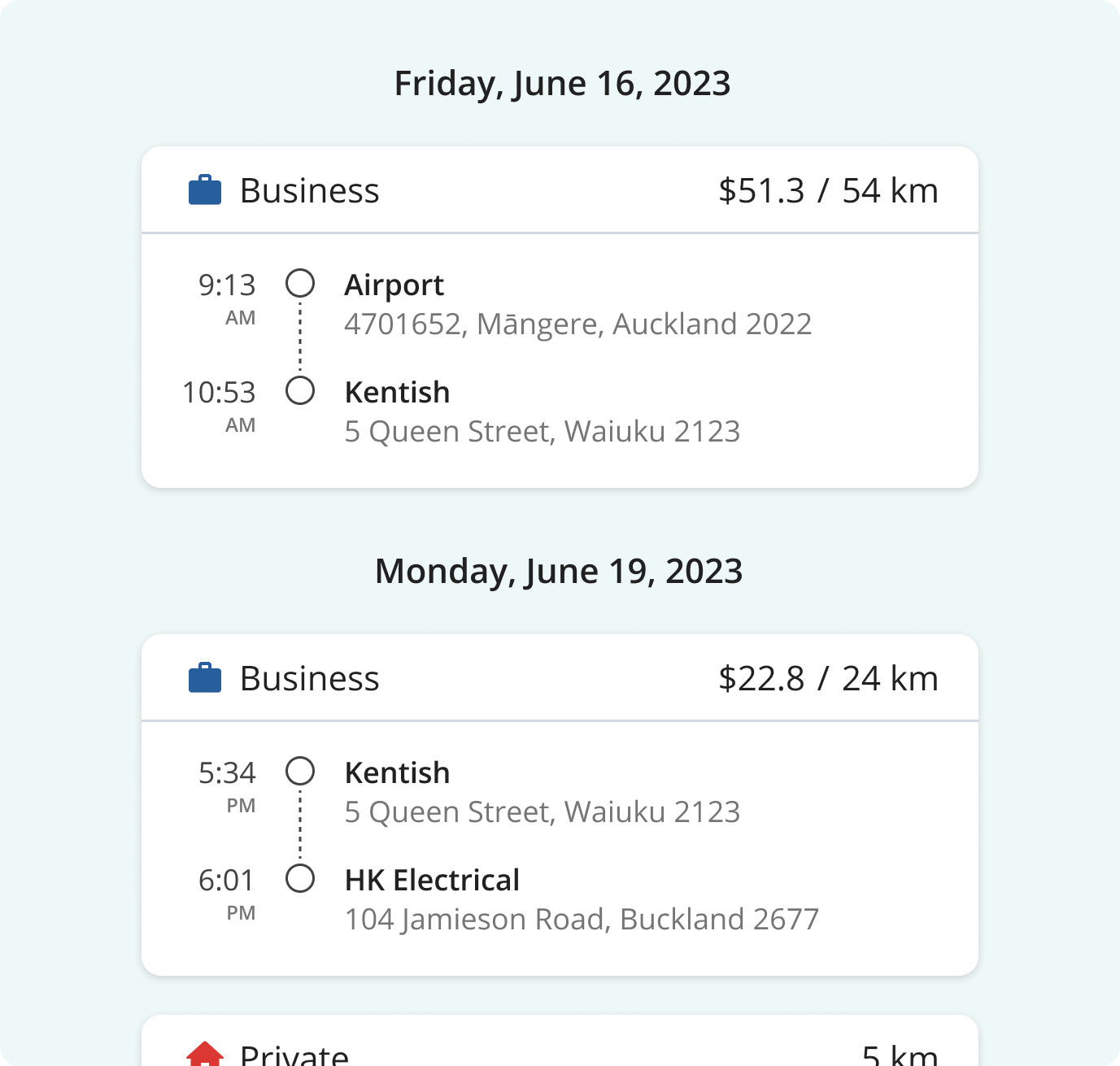

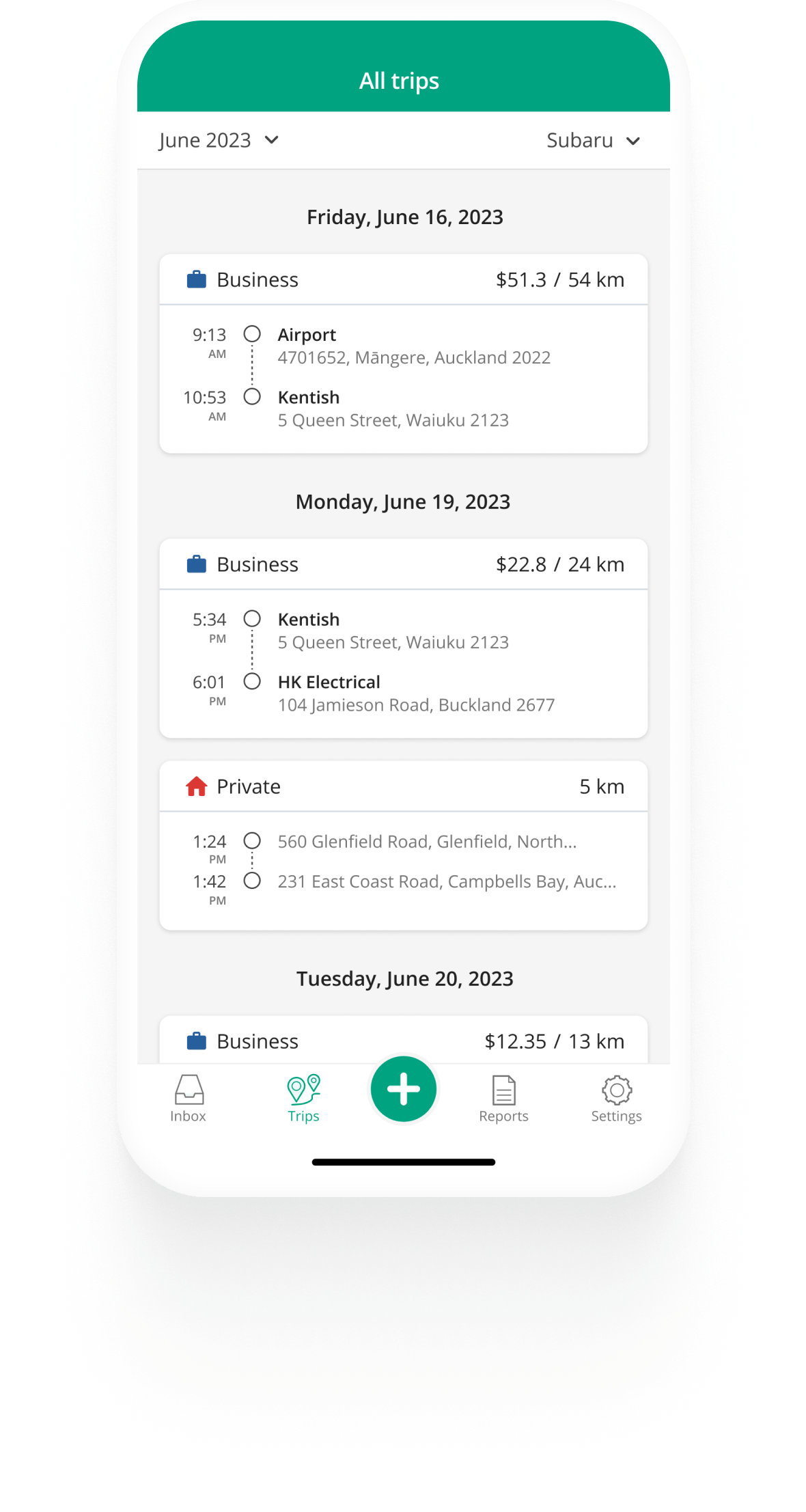

Intelligent classification

The app seamlessly detects who you visited and suggest the purpose of the trip, while making it easy to correct.

4.7 / 5

100,000+ App reviews & ratings

100,000+ app reviews & ratings via Google Play & App Store