Your logbook is ready when needed

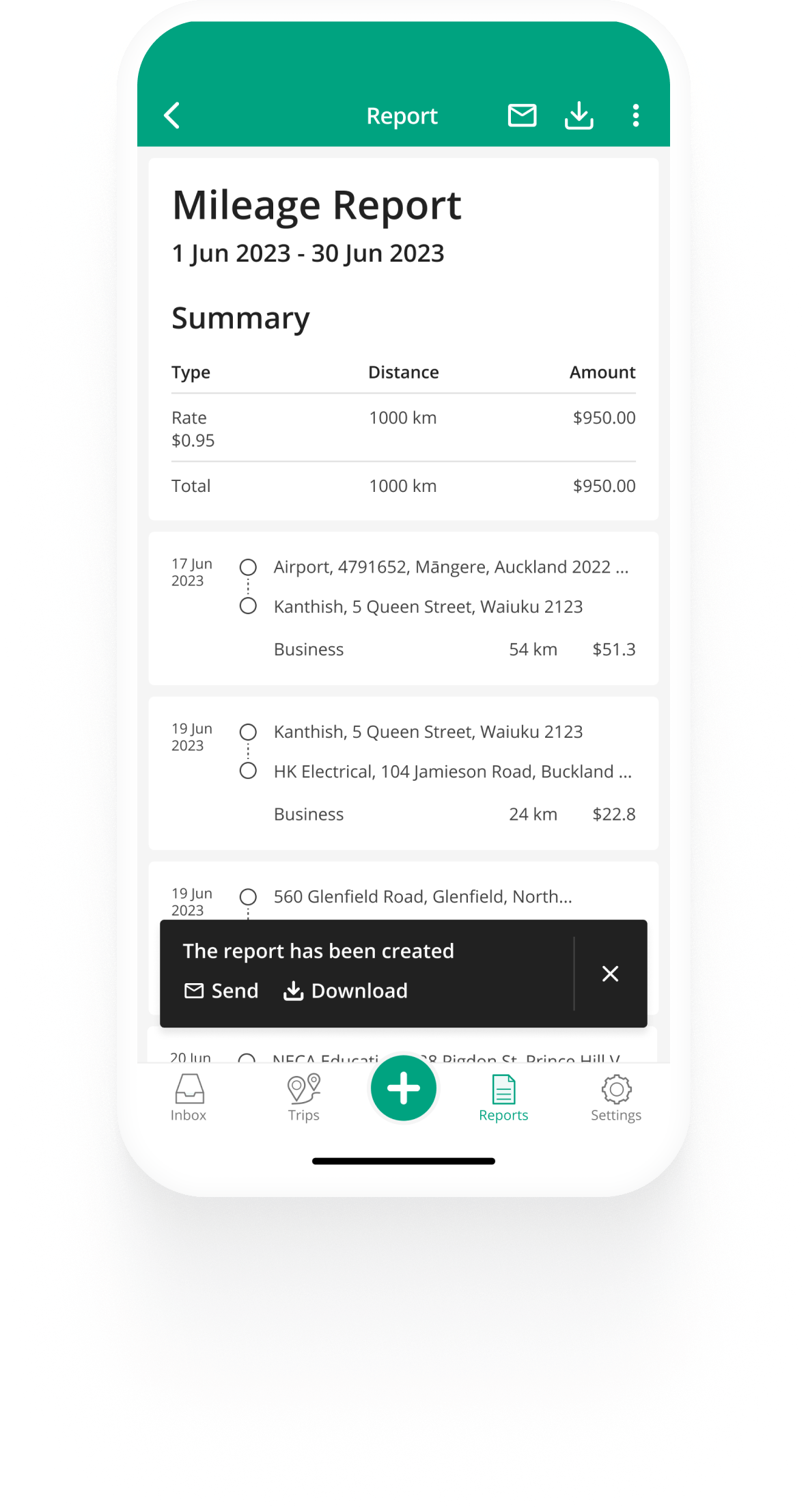

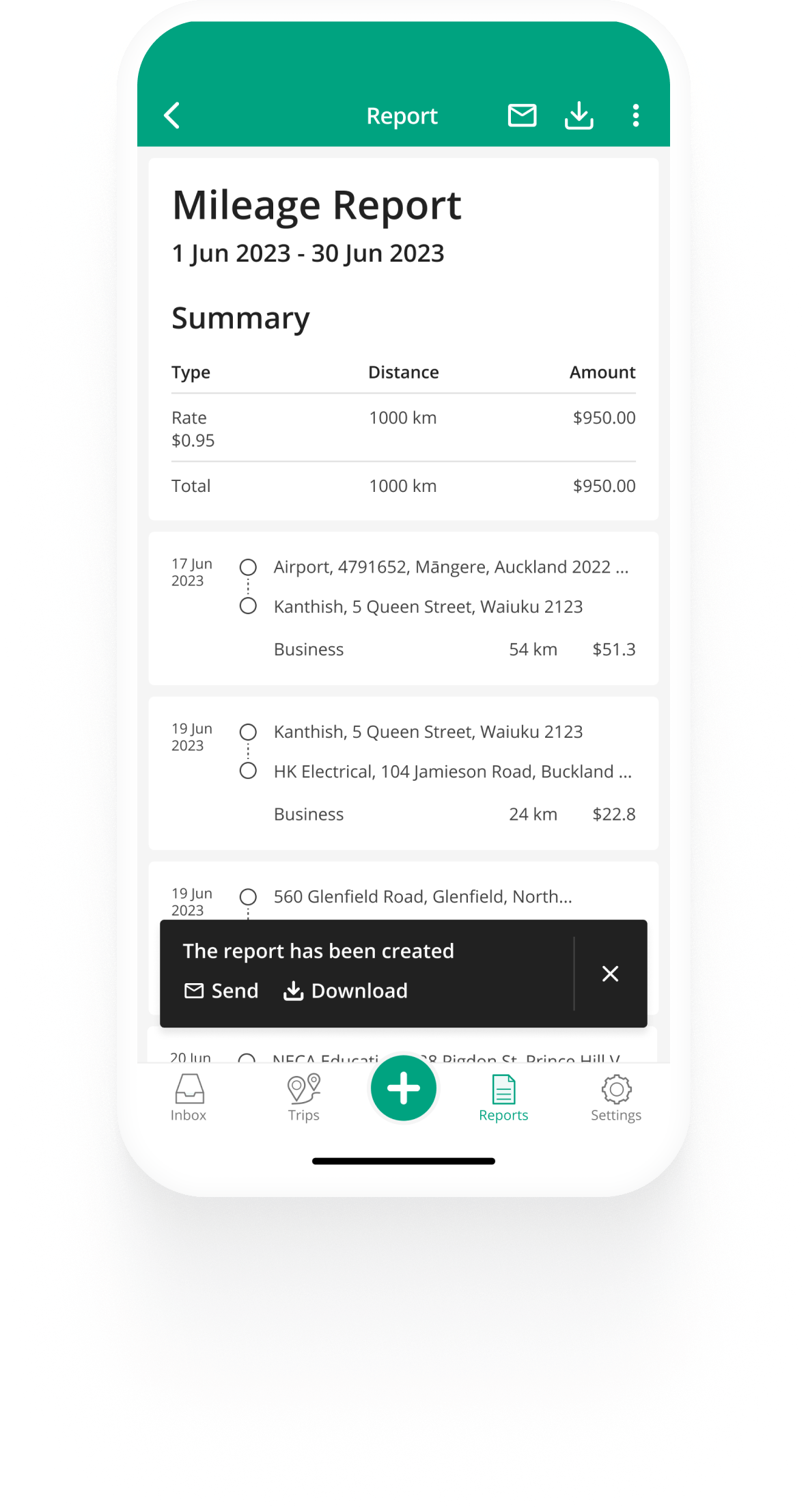

Your mileage logbook is ready when you are. You’re only one click away from detailed reports available on mobile or desktop.

Your mileage logbook is ready when you are. You’re only one click away from detailed reports available on mobile or desktop.

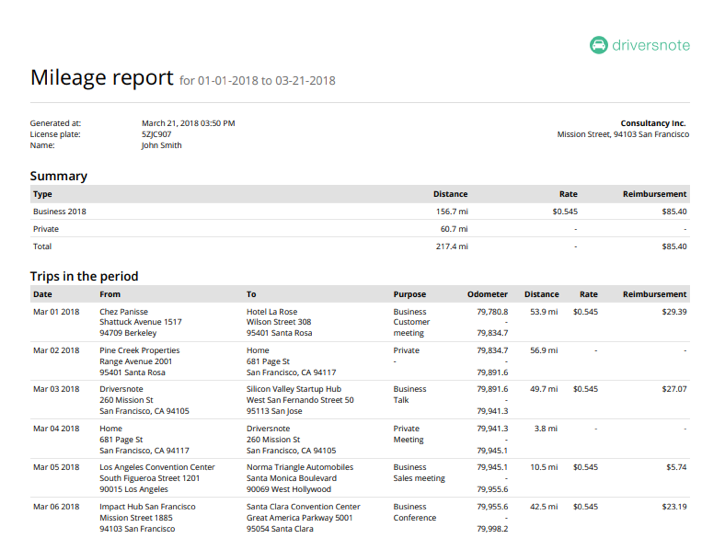

Get a customizable report of all of your trips, downloadable as a PDF or Excel file, ready to hand over to your employer or accountant.

The logbook is ready to be used as documentation for e.g. reimbursement claims or submitted to the IRD for tax deductions.

From the get-go, the Driversnote logbook app automatically calculates your reimbursement based on the IRD mileage rates that we make sure to keep up to date for you. If you’d like, you can set your own custom corporate rates or choose not to calculate reimbursements at all.

If you need to regularly document the status of your car’s odometer, we’ve got you covered. We make it easy to log and can even send you reminders. You choose how often to log the odometer, and we do all the math for you and include it in your report.

Do you need to keep a mileage logbook for multiple vehicles or report mileage to more than one employer? No problem. You can easily segment your trips and reporting for different vehicles and workplaces.

Your mileage log book needs to contain general information for your driving throughout the year, as well as details for each trip you take during that year. This includes your yearly mileage as well as the date, start and end locations and the purpose (e.g. Personal or Business) of each journey. Use Driversnote for automated trip logging with all the required information.

The IRS stipulates that you must keep a timely and adequate record of your miles. This means you should update your mileage log book at least once a week and log all the required details for your journeys.

You can use a paper book, a PDF or Excel file as your mileage log book, so long as you log all the needed information for your business miles. Keeping manual logs may become tedious if you drive for work often, so we recommend trying out an automatic mileage log book app such as Driversnote that will record the information for you and help you generate a mileage log at the touch of a button.