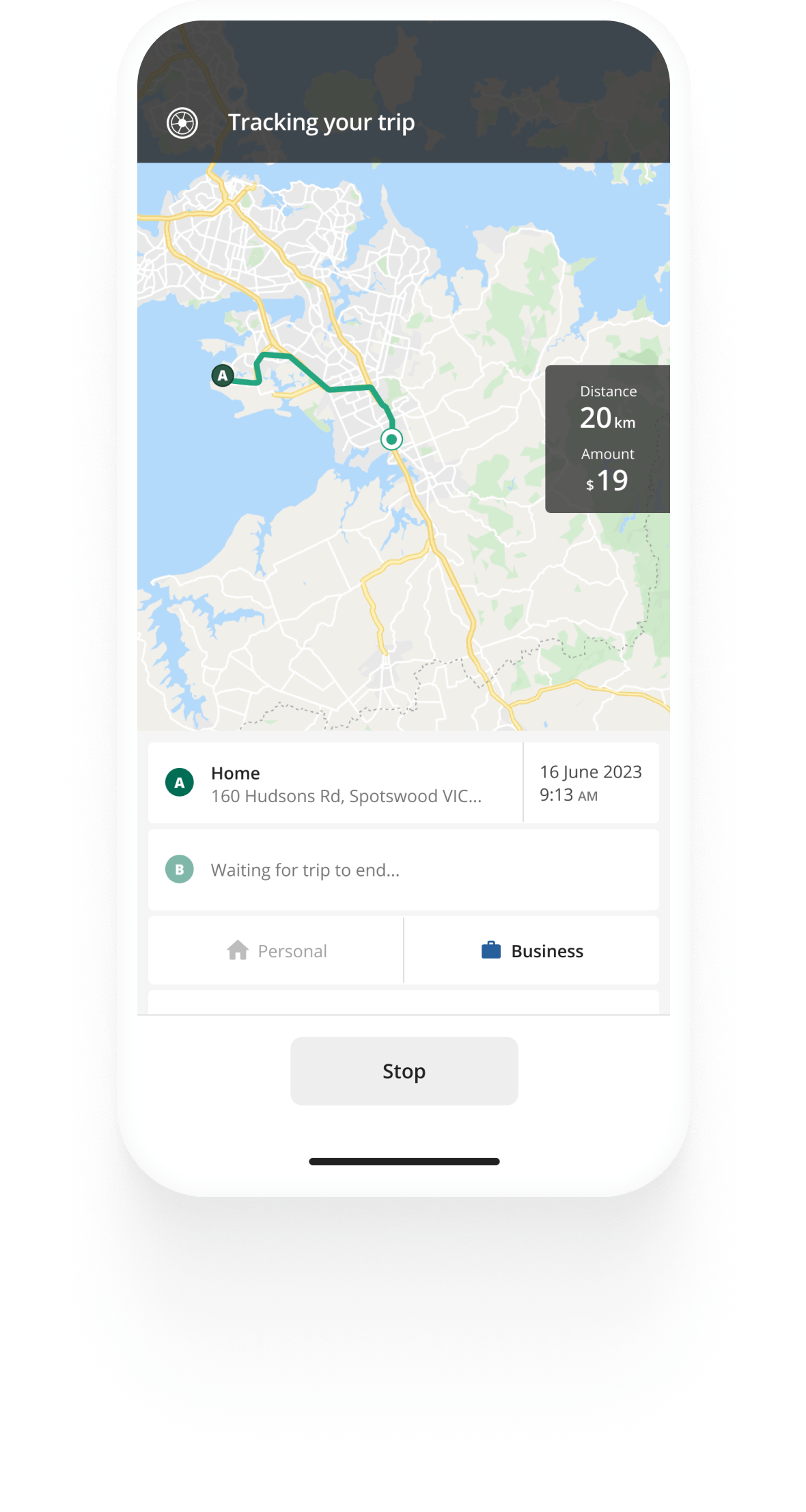

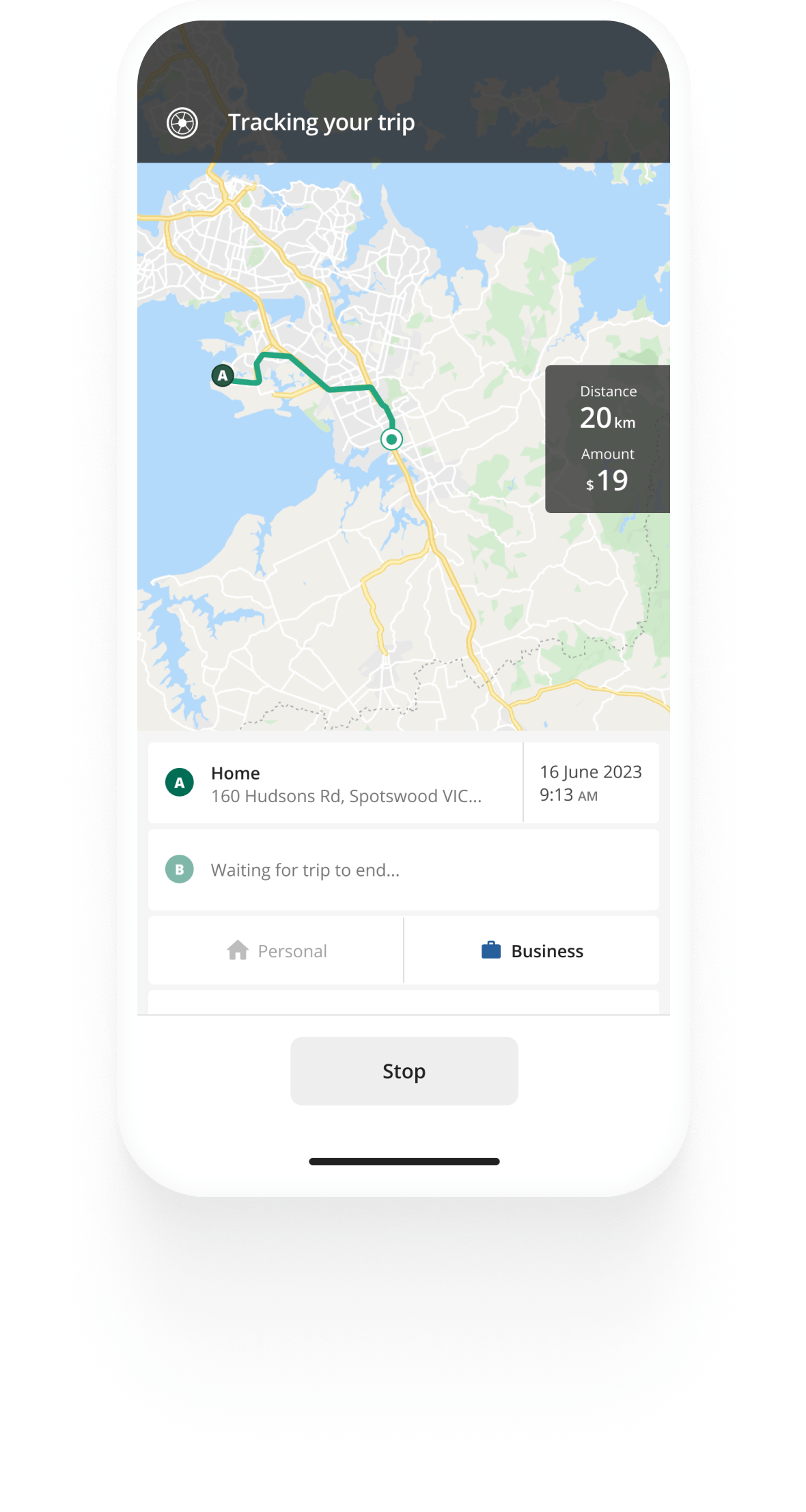

Track mileage automatically

Get startedTax Liability

In this article

Tax liability refers to the amount of tax a taxpayer owes to a tax authority based on their taxable income and the tax rates applicable to their income bracket. It is the legal responsibility of individuals, businesses, and other taxable entities to pay taxes on their income, profits, capital gains, or any other taxable transactions.

What is tax liability?

Tax liability is determined by calculating the taxable income, which is the total income earned minus any allowable deductions and exemptions. The tax liability is then calculated based on the tax rates set by the tax authorities.

Tax liability can vary depending on the tax laws and regulations of different countries or jurisdictions. Additionally, tax liability can be influenced by various factors such as filing status, eligible deductions, and tax credits.

Your tax liability doesn't just account for the current year; it also factors in previous years for which you might owe taxes.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and IRD-compliant reporting.

Get started for free Get started for freeWhat affects tax liability

Several factors influence the calculation of tax liability. The most common ones include:

Income

For individuals, the primary source of tax liability is their income. This includes wages, salaries, tips, and other forms of earnings. In most countries, income tax rates vary depending on the amount earned. Generally, higher incomes are subject to higher tax rates.

Business profits

Tax liability for businesses is based on their net profits after deducting allowable business expenses from their total revenue. Corporate tax rates often differ from individual tax rates.

Capital gains

Tax liability can also arise from the sale of assets like stocks, real estate, or other investments. The difference between the purchase price and the selling price is considered a capital gain and may be subject to taxes.

Deductions and credits

Tax deductions and credits can help reduce tax liability. Deductions, such as those for mortgage interest or charitable donations, reduce taxable income. Credits, on the other hand, directly reduce the amount of tax owed.

Filing status

Tax liability can vary based on individuals’ filing status (e.g., single, married, head of household). Different statuses have different tax brackets and deductions.

Determining tax liability

To determine tax liability accurately, individuals and businesses are required to file tax returns with the government authorities. Taxpayers must report their income, deductions, and any applicable credits on the tax return form. The tax return will calculate the total tax liability, and if the taxpayer has already paid some taxes throughout the year (e.g., through employer withholding), the amount already paid will be deducted to arrive at the final amount owed or refunded.

FAQ

Tired of logging mileage by hand?

Effortless. IRD-compliant. Liberating.