Track mileage automatically

Get started

IRD Kilometre Rates 2023-2024

The IRD has announced the kilometre rates, also referred to as mileage rates, for the 2023-2024 income year. The rates are $1.04 for petrol, diesel, hybrid and electric vehicles for up to 14,000 km. After 14,000 km, the rates are $0.35 for diesel and petrol vehicles, $0.21 for hybrid vehicles, and $0.12 for electric vehicles.

| Vehicle type | Tier 1 rates (up to 14,000 km) | Tier 2 rates (over 14,000 km) |

|---|---|---|

| Petrol or diesel | $1.04 | $0.35 |

| Petrol hybrid | $1.04 | $0.21 |

| Electric | $1.04 | $0.12 |

Changes to the 2023-2024 IRD kilometre rates

The rates have increased for all vehicle types in both Tier 1 and Tier 2 in light of changing fuel and car maintenance costs.

The IRD has a history of revising the kilometre rates and changing them every year. Since 2017, the Tier 1 rates have increased by at least two cents per kilometre every year. However, Tier 2 rates actually decreased in the 2019-2020 and 2020-2021 income years and again went up for the 2021-2022 and 2022-2023 income years due to the high fuel prices.

This year, the IRD has increased the rate for the first 14,000 km by 9 cents, the biggest increase so far. All rates for kilometres over 14,000 have increased by a cent.

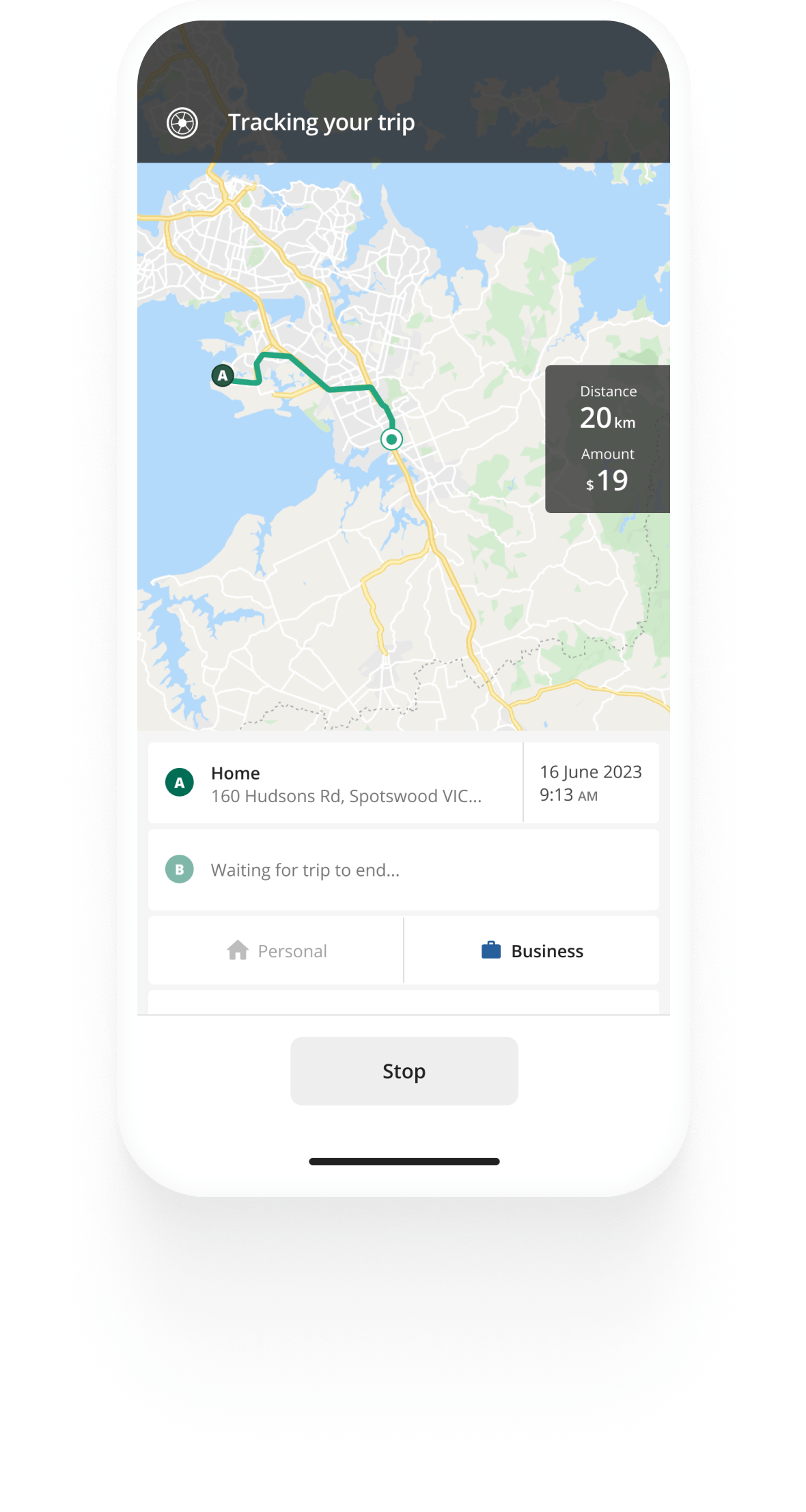

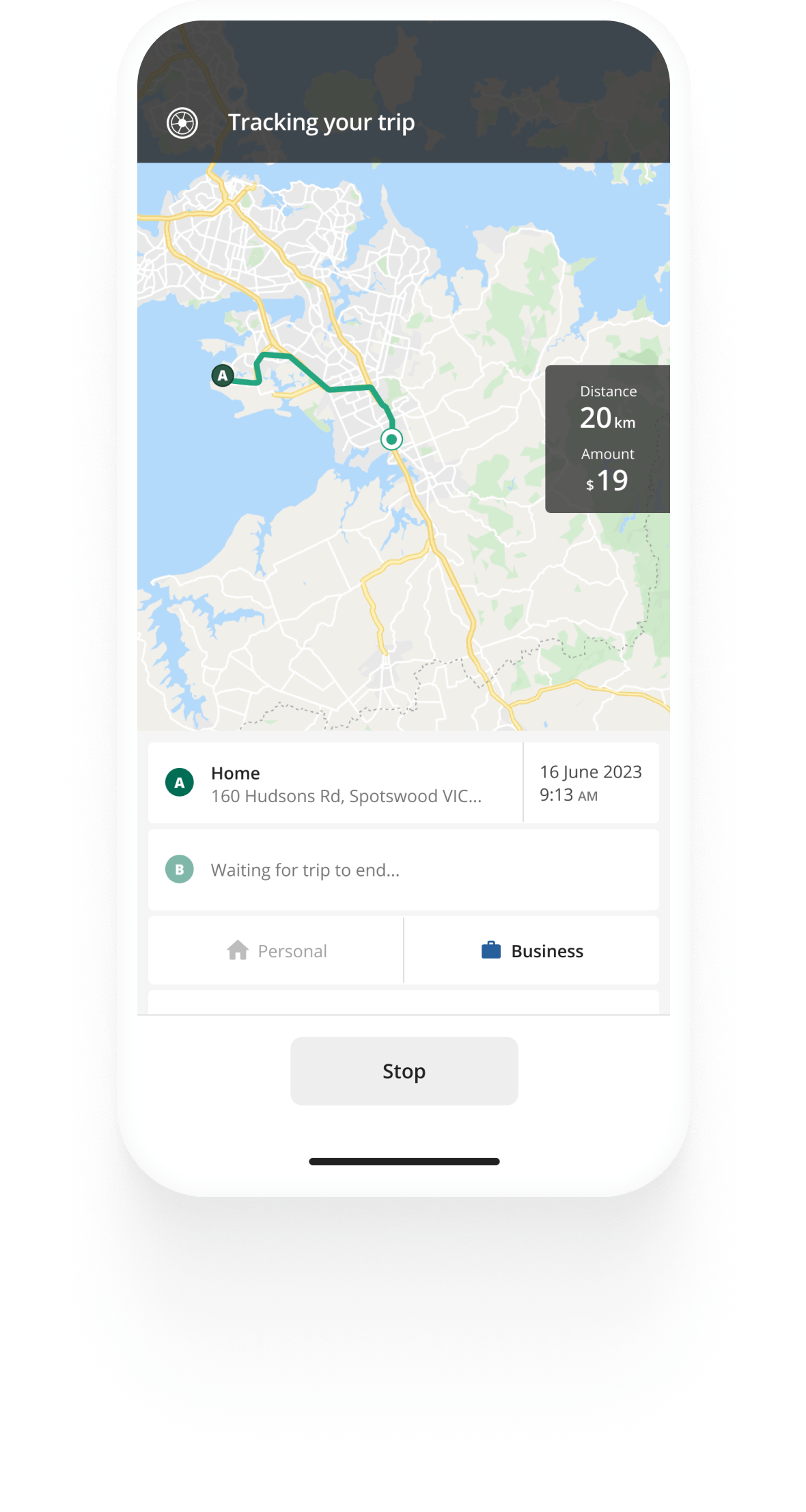

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and IRD-compliant reporting.

Get started for free Get started for freeUsing the kilometre rates according to your situation

The Tier 1 rates take into account your vehicle's fixed and running costs. Use these rates for the business portion of the first 14,000 kilometres you travel with your vehicle in a year, including personal travel.

The Tier 2 rates only account for your vehicle's running costs. Use them for the business portion of all travel over the first 14,000 kilometres.

For example, if you drove 5,000 business kilometres of the first 14,000 total kilometres, use Tier 2 rates to deduct all business kilometres over the 5,000th.

Records you need to keep

You must keep a logbook of your business and personal driving to get Tier 1 reimbursement or deductions for the first 14,000 km (total). If you don’t keep records of your driving, you can only claim Tier 1 rates for the first 3,500 km of business-related driving.

As a self-employed or a qualifying close company

If you are a sole trader or a qualifying close company, you can use the kilometre rates to claim business vehicle costs by the kilometre rate method for the income year 1 April 2023 - 31 March 2024 if you have a standard balance date.

To work out your claim, multiply your business kilometres by the applicable rate for your vehicle type. The official kilometre rates include vehicle depreciation, so you won't be able to claim it in addition to the rates. There is no GST to take into account.

Note that you must use the same method for your business kilometres claim. If, for example, you claimed actual vehicle expenses last year, you won't be able to switch to the kilometre rates method as long as you drive the same vehicle.

As an employer

If you reimburse employees for work-related travel according to the official IRD rates, the new ones will apply to the reimbursements you provide from the date the rate is issued. However, if you don't provide reimbursements or reimburse at another rate specified in your employees' contracts, you are not obliged to change your vehicle reimbursement policy. So long as the rate you provide is at or lower than the IRD rates, the reimbursements will be tax-free.

As an employee

Receiving reimbursement for your business kilometres with a personal car will depend on the agreement you have with your employer. If agreed upon, you will receive reimbursement according to the official IRD rates. The new rates will be applicable to your reimbursement from the date of their issue. However, employers are not obliged to use the IRD rates if this is not stipulated in your contract and may choose to reimburse you at a lower rate than the most recent official rates. Your reimbursement will be tax-free if you receive a rate per kilometre at the official or lower than the IRD rates.

Tired of logging mileage by hand?

Effortless. IRD-compliant. Liberating.

Top posts

- IRD 2022-2023 Kilometre Rates

- Denmark increases mileage rate due to rising fuel prices

- Introducing Driversnote for Web