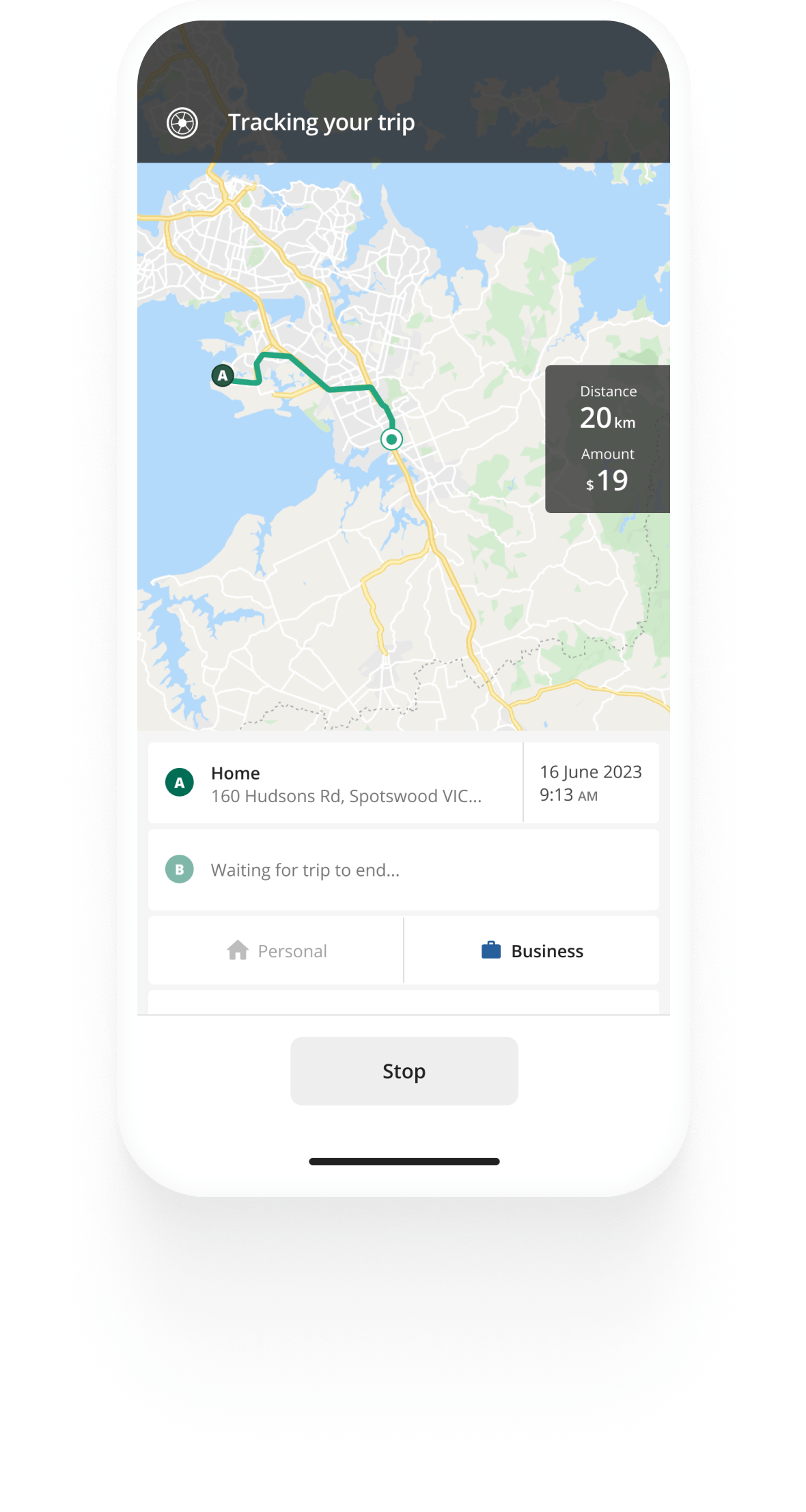

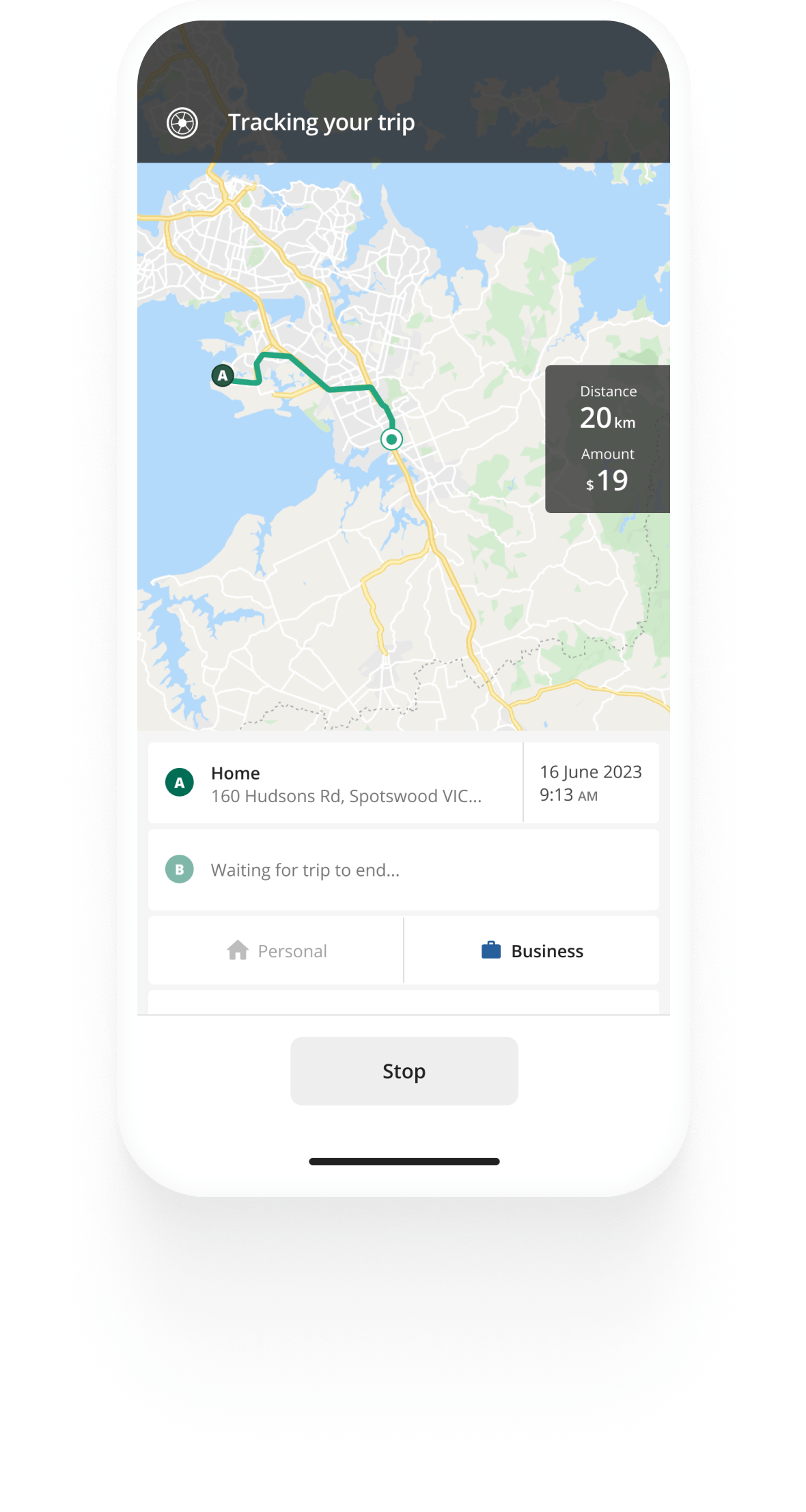

Track mileage automatically

Get started.svg)

IRD 2022-2023 Kilometre Rates

The IRD has published the kilometre rates at which you can get tax-free deductions if you’ve used your personal vehicle for business-related purposes in the 2022-2023 tax year. See the rates and how to use them below.

2022-2023 kilometre rates

The kilometre rates have steeply increased compared to the previous tax year, meaning you can get more money back to cover your expenses for each kilometre you’ve driven for business.

| Vehicle type | Tier 1 rates | Tier 2 rates |

|---|---|---|

| Petrol or diesel | 95 cents | 34 cents |

| Petrol hybrid | 95 cents | 20 cents |

| Electric | 95 cents | 11 cents |

Have you considered automating tracking your kilometres for a hassle-free, accurate logbook? Get the Driversnote vehicle logbook app today.

Tier 1 kilometre rates

Use the Tier 1 kilometre rates to claim business-related driving for the first 14,000 km you’ve driven throughout the 2022-2023 tax year. The Tier 1 rates cover your vehicle’s fixed costs, such as road tax, insurance, depreciation, and variable costs, including fuel, repairs, and maintenance.

Note that the 14,000 kilometres limit applies for all of your driving - both business and private. This means that if in the first 14,000 km you accrued on your vehicle 8000 km was for business, you can claim 95 cents per km for these 8000 km. After that - you must use the Tier 2 rates.

Tier 2 kilometre rates

Use the second tier of rates for claiming any business kilometres over the 14,000 km threshold. These rates are only intended to cover your vehicle’s variable or running costs.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and IRD-compliant reporting.

Get started for free Get started for freeWhy the kilometre rates went up for the 2022-2023 tax year

The IRD has decided to increase the kilometre rates in both tiers due to the higher costs of running a vehicle, noting specifically the higher fuel costs throughout the tax year.

Using the 2022-2023 kilometre rates

Use the kilometre rates to claim your business-related travel with your vehicle for the 2022-2023 tax year at tax time. To do so, you must’ve kept a logbook to work out how many kilometres you’ve driven for business, kilometres directly resulting in producing assessable income.

If you have your logbook, you then use the kilometre rates to calculate the deduction for the business use of your vehicle.

If you are self-employed and using the kilometre rates for claiming work-related travel, you don’t need to worry about GST - there is none. Note that the official kilometre rates include vehicle depreciation, so you will not be able to claim it separately.

Finally, don’t forget that if you have claimed business kilometres for the last tax year, you are obliged to continue using the same method for your claim. If you claimed actual vehicle expenses last year, you will not be able to switch to the kilometre rates claim method, if you continue to drive the same vehicle.

FAQ

Tired of logging mileage by hand?

Effortless. IRD-compliant. Liberating.

Top posts

- IRD Kilometre Rates 2023-2024

- Denmark increases mileage rate due to rising fuel prices

- Introducing Driversnote for Web