Track mileage automatically

Get started

Tips on finding the best mileage tracking app for New Zealand

Using a mileage tracking app can save you a lot of time. Keeping track of your trips and creating proper reports is a big responsibility and there are a couple of features that you should definitely look for in an app. In the best case, your mileage tracking app is not only tracking your trips but also serving as a logbook too.

Mileage tracking and vehicle log books

The Inland Revenue Department requires you to keep adequate records of your trip to receive your mileage reimbursement. If you have a vehicle that is exclusively used for business, you can deduct the total cost of maintenance as a business expense. If you use your car for both business and private matters, you'll need to figure out how to properly allocate costs. The trip from home to work is considered a private trip and cannot be reimbursed. To clearly separate the two types of trips, you can use a vehicle log book where you would log all trips taken and separate them into business or personal.

By using the Inland Revenue’s mileage rates for 2021 and keeping a vehicle logbook, you can make sure that all your reports are in order and you can easily receive your reimbursement.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and IRD-compliant reporting.

Get started for free Get started for freeWhat to look for in a mileage tracking app

Accurate tracking

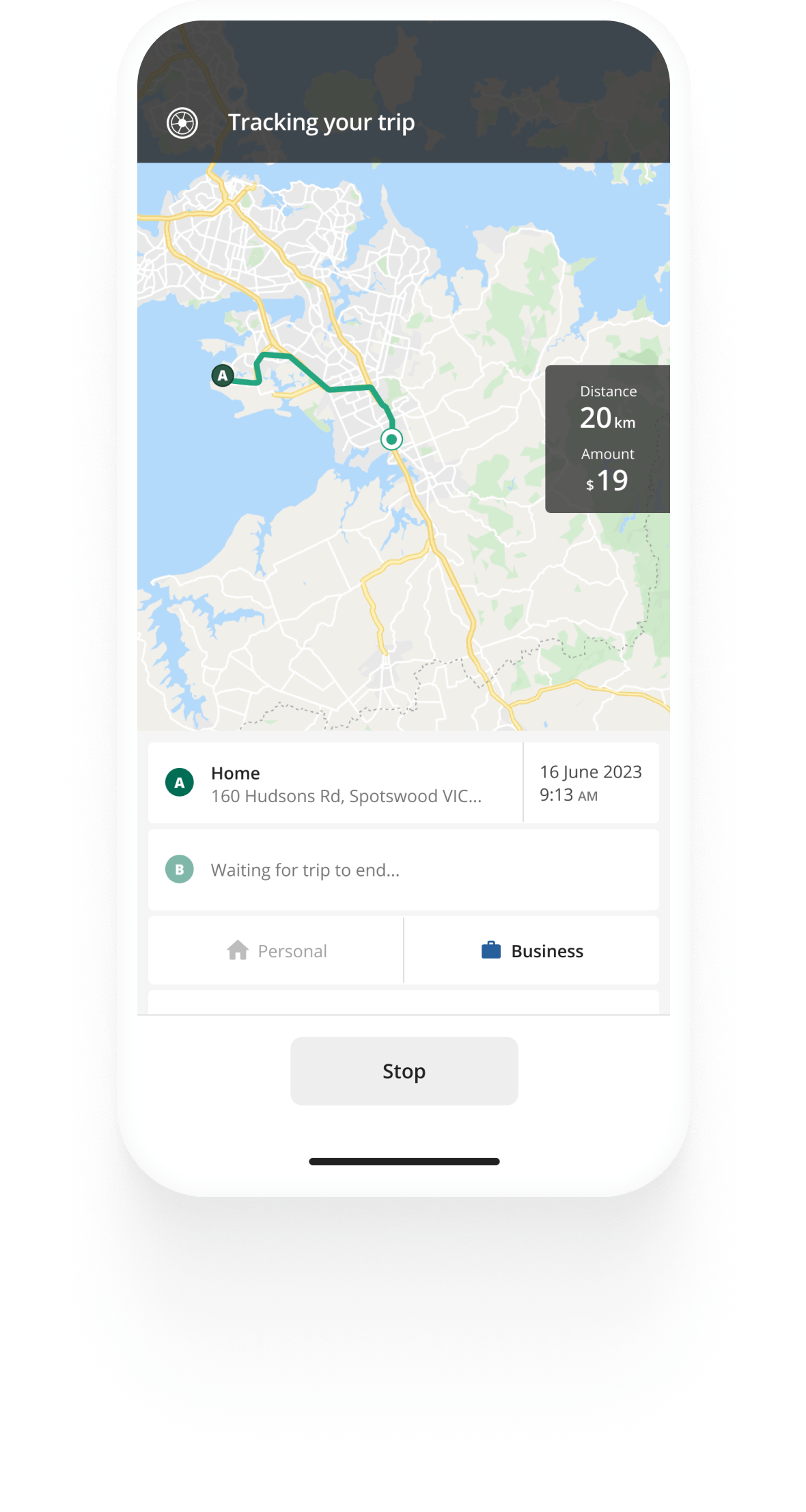

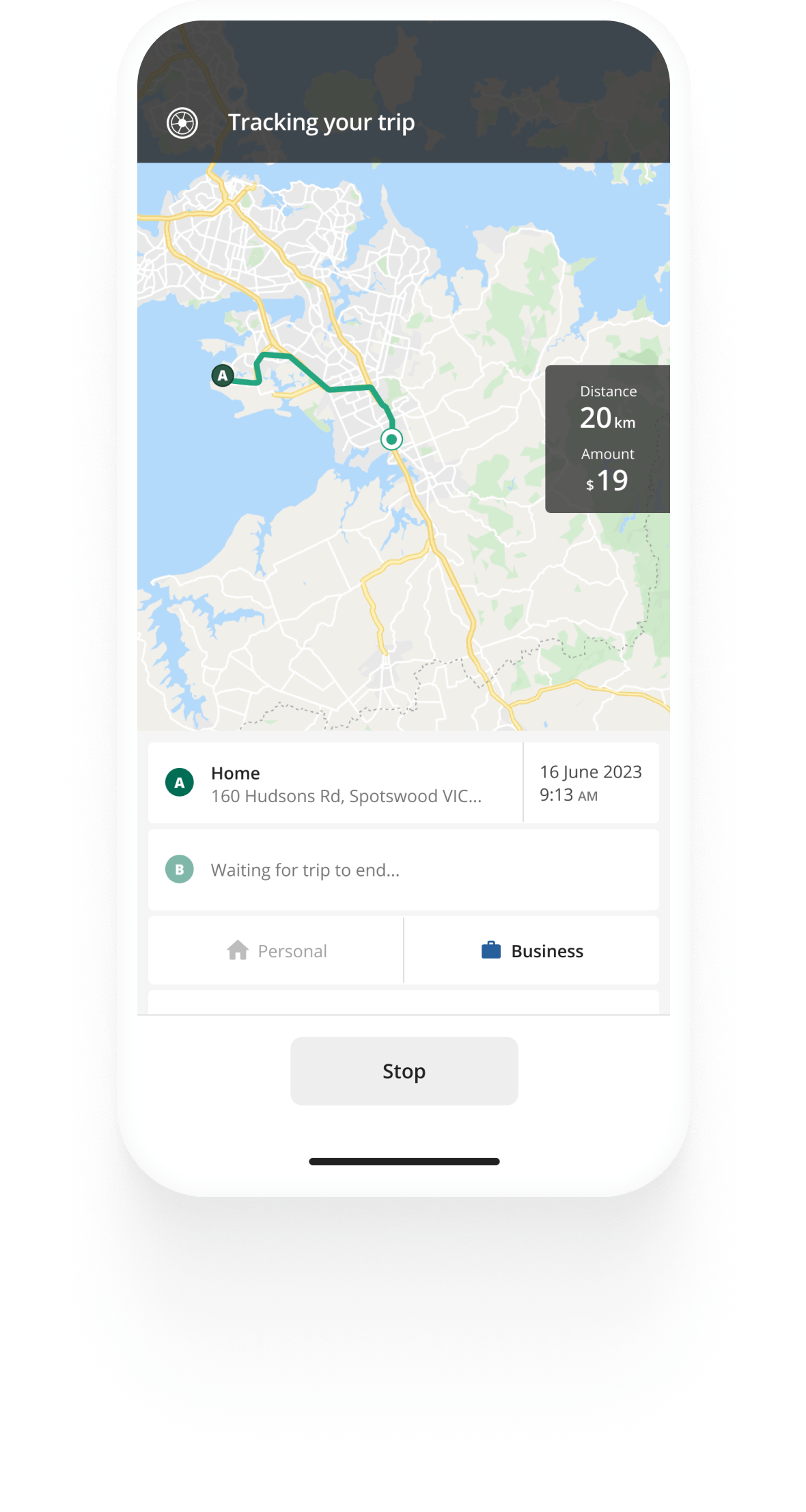

The most obvious, yet most important, feature of a mileage tracking app is the tracking itself. The difference between some of the apps out there is that some will only allow you to log information for trips, while others will use your phone's GPS to track your drives in real time, documenting the route you took and when you arrived. Real-time GPS tracking can be essential if you want to document every single trip you take.

Keeping adequate records in your vehicle log book can save you a lot of money. According to the Inland Revenue Department, if you do not keep a logbook, your claim will be limited to 25% of the vehicle running costs as a business expense, which means you will be reimbursed a lot less than if you had kept a logbook.

Classify your trips

If you use your personal vehicle for work, you will likely use it for personal and business trips. A good mileage tracking app should have the option of assigning a purpose to your trips - if they are personal or business-related, so that you can keep track of the correct percentage you have been using your car for business.

Creating compliant mileage records

The best mileage tracking apps will be able to automatically apply and calculate the reimbursable amount for each trip according to the IRD standard rates for your mileage records. The correct amount for deduction or reimbursement should be visible in the mileage reports you create from the app, along with all other necessary information for adequate IRD records, including the time and destination of your trips, and their purpose.

Other features your mileage tracker app may have

Apart from the features mentioned above, there are a couple of other things you may want to make sure your mileage tracker or vehicle log book has.

Automatic tracking

Most apps include automatic tracking—you don't even have to open the app because it tracks your mileage in the background. When it detects movement, this type of automatic tracking will record a trip. Keep in mind that your mileage log may include bus and taxi rides, as well as trips where you were the passenger and not the driver - which is why you may want to get auto tracking for only relevant trips.

Auto-tracking for only relevant trips

Some apps also provide automatic tracking, which tracks trips only when you are driving your car. Using a small device set up in your vehicle, trips start and stop automatically. When you enter your vehicle, the device connects to your phone and prompts tracking to begin. When you exit the vehicle, tracking will automatically come to a stop and the trip will be completed. This ensures that your vehicle log book contains only relevant trips.

Custom mileage rates for your logbook

The best mileage tracking apps allow you to customize your mileage reports so that they include information that is relevant to your situation. In case your employer reimburses you at a rate other than the standard IRD mileage rate, you should be able to name a workplace and your vehicle, as well as set the custom mileage rates you need.

Detailed mileage documentation

Sometimes creating a report may not be enough. The best app for you will ensure that your reports have all the necessary information and can be generated in different formats. Get an app that can produce your logbook reports in PDF, Excel or Sheets.

Make sure to check a few example reports before choosing your app as you need to make sure they are IRD compliant.

Tired of logging mileage by hand?

Effortless. IRD-compliant. Liberating.

Top posts

- IRD Kilometre Rates 2023-2024

- IRD 2022-2023 Kilometre Rates

- Denmark increases mileage rate due to rising fuel prices